The four-verse tale of the widow’s mite underscores charitable giving (Luke 12:1-4). Had that widow lived in present-day Arizona, her deep financial sacrifice would mean just as much. If she donated it to a specific cause within the treasury however, she’d be able to get those two coins back in the form of a tax credit.

Among the 30-some tax credits available in the State of Arizona, Catholics should take note of a trio: tuition, charitable and foster care organizations.

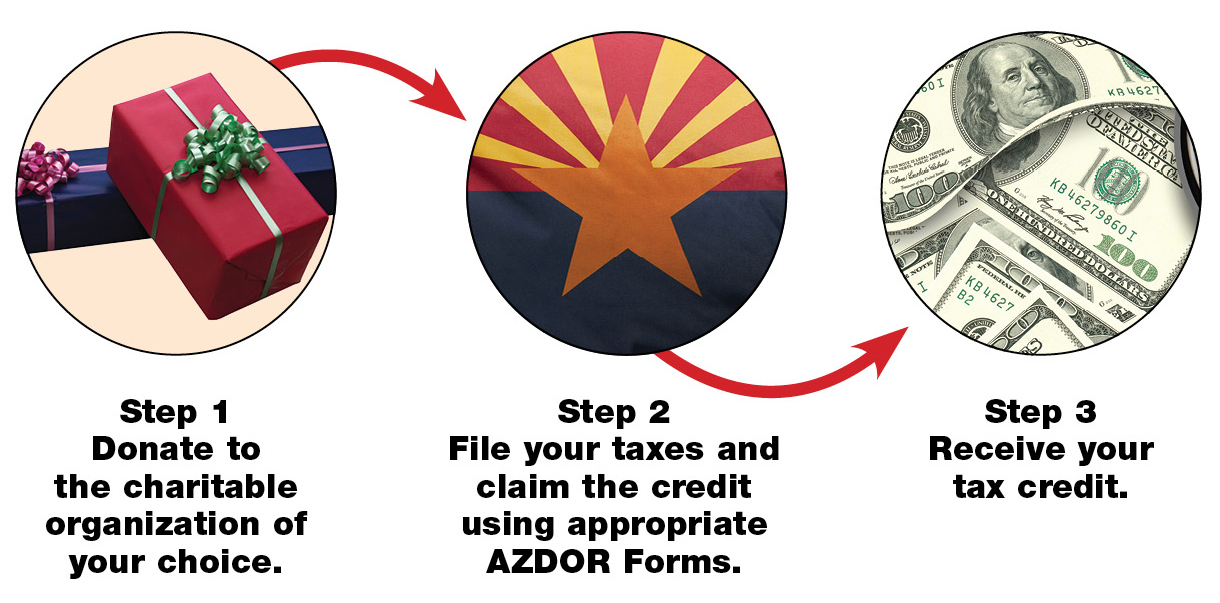

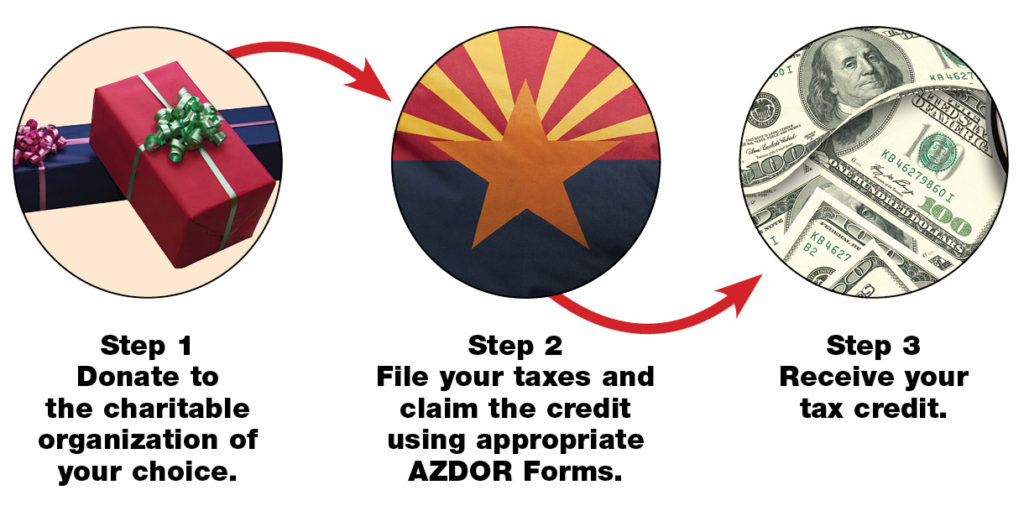

How to give

❑ Discern which organization(s) to support.

❑ Know your limits — check line 46 of last year’s tax return for most filers.

❑ Donate via your preferred method (check, credit card, online) by Dec. 31.

❑ Print receipt and show to tax preparer or if preparing them yourself, fill out Form 321 (charitable), Form 352 (foster care) and/or Form 323 (school tuition). Also fill out Form 301 to total nonrefundable individual tax credits.

“The credits reduce your liability dollar for dollar,” said Ann Couch, a certified public accountant and St. Theresa parishioner who serves on the Catholic Community Foundation’s professional advisory board.

Tax credits are “a re-directing of your tax liability. You’re just saying to Arizona: Take a piece of the taxes I’m paying to you and instead re-direct it to this charitable organization,” Couch said.

Donors can tally up financial gifts they’ve made to such organizations throughout the calendar year or give all at once. They technically have until April 16, 2018 to do so — the usual tax day falls on a Sunday next year — but Couch offered a caveat.

“These credits are also generally deductible on federal [tax returns,]” Couch said. If donors plan to use that option too, they must make their contribution by Dec. 31 in order to take advantage of both deals for the same tax year.

“Even if you don’t itemize, you can still get the credit. It helps you on Arizona [tax returns]. It doesn’t necessarily help on federal,” Couch said.

The tax credit is also guaranteed to help whoever receives that money.

School tuition organizations

Where to give – Schools

($546 single, $1,092 jointly)

Thousands of students received a need-based scholarship from Catholic Education Arizona to attend one of the 38 Catholic schools across the Diocese of Phoenix last year. Parents can quickly see the difference the tax credits make when their tuition bill is suddenly hundreds, if not thousands, less. At $120 million to cover tuition for every student, there is substantial unmet need.

“The best news is that the Diocese of Phoenix has a tax base that would make it possible to fund the tuition needs in all 38 schools,” Catholic Education Arizona CEO Maureen Adams said. She invited anyone who pays state taxes, large or small, to participate.

Couch described the simple process. “You write a check. You make a credit card payment. You go online — however you normally pay a bill. You print out a receipt and you bring it to your tax preparer.”

An average of 12,100 taxpayers choose one of those options for Catholic Education Arizona each year. All told, more than 110,000 students have received $183 million in tuition assistance from CEA since its founding in 1998.

“Our schools are dedicated to building healthier families, stronger communities and future businessmen and women who promote the values, ethics and morals learned in our schools,” Adams said.

Charitable organizations

Where to give – Charities

($400 single, $800 jointly)

➤ Fatima Women’s Center (Tucson)

➤ Foundation for Senior Living

➤ Life Choices Women’s Clinics

➤ Sister Jose Women’s Center (Tucson)

Today’s businessmen and tradesmen often need help too, especially if they’re trying to re-enter the workforce. Nearly 3,900 individuals succeeded in the last fiscal year thanks to St. Joseph the Worker which removed some barrier to employment, assisting clients with a clean résumé, suitable interview/work attire, a bus pass to get there, plus tools or employment prerequisites such as certifications and licensing.

“As a 100-percent privately funded nonprofit, every donation makes a significant impact and directly supports our mission by providing the tools and resources needed for homeless and low-income individuals and families to secure employment and pull themselves out of homelessness and poverty,” said Brent Downs, St. Joseph the Worker’s executive director. His office receives roughly 30 percent of its revenue for the fiscal year in December when most take advantage of the tax credit. That includes first-time donors as word of their mission spreads.

“Also, I imagine that some donors like to ‘switch it up’ among charities each year, thus making them on the lookout for different nonprofits,” Downs said.

A couple that are hard to miss in Catholic circles are the Society of St. Vincent de Paul and Catholic Charities Community Services. Whether donors give little by little throughout the year or all at once toward New Year’s Eve, every penny helps sustain their daily outreach to those in need.

“The tax credit is a great incentive for donors, beyond the satisfaction knowing how their dollars are going to help the most vulnerable in the community,” said Shannon Clancy, associate executive director and chief philanthropy officer for St. Vincent de Paul. She added that the financial and volunteer support of the community inspires staff and ensures “that our critical programs are still here in April and July and September when people are still relying on us in their moment of need.” That will be especially true when a new St. Vincent de Paul facility opens next summer allowing its ministries to serve even more.

“We feel very blessed to be a place in our community where those who seek assistance and those who offer support can come together on the common ground of God’s love,” Clancy said.

That’s the kind of outlook staff and volunteers at Maggie’s Place have too. Its four Valley houses put mission corps staff and women facing unplanned pregnancies under the same roof to journey together toward a birth plan. Maggie’s Place saved and restored 126 lives this year through its hospitality, saw 100 moms in its job readiness programs and welcomed 932 moms to its Family Resource Center.

Donors who support pro-life organizations like Maggie’s Place and crisis pregnancy centers also qualify for the charitable tax credit.

Foster care organizations

Where to give – Foster care

($500 single, $1,000 jointly)

Beginning with the 2016 tax year, donors can also claim a separate tax credit for financially supporting a “Qualifying Foster Care Charitable Organization.” Catholic Charities is among 40 organizations on the approved list.

So is OCJ Kids and Arizona Friends of Foster Care Children. One heavily networks with St. Patrick-based For the Love of Kids Ministry and the other regularly connects with Furnishing Dignity, a Catholic-run nonprofit that helps children aging out of foster care and others set up their home.

“It doesn’t cost anything, but you can still feel like you’re giving something,” Couch said of tax credits. “There are people who might not give otherwise but they might be persuaded to give their maximum if it’s a credit.”

Each credit carries its own limit for people filing individually or jointly. Regardless, taxpayers can only claim as a tax credit up to the matching amount of their liability. Couch said to look at line 46 of last year’s state return for residents as a guide.