NEW: IRS extension to file 2020 tax returns by May 17, 2021, NOW INCLUDES an extension for AZ taxpayers to make their Individual Tax Credit Contribution.

There are few greater joys for a mission than bringing hope and healing to the underserved. But positive outreach to struggling neighbors has become a challenge this past year. The global health pandemic has made it difficult for many people to find the services they need.

Approximately 1.1 million Catholics make The Diocese of Phoenix a diverse, vibrant and faith-filled community. Together they’ve built some of the most impactful schools, organizations and charities in Phoenix. The Diocese provides hands-on help for seniors, those who are homeless, those who have lost jobs, women who have been abused and families in crisis.

Serving the Diocese are four vital and engaged nonprofits. Learn how these organizations are making a difference and how you, too, can be part of the solution that helps make a difference in the lives of others through tax credits, donations and endowments.

Catholic Charities Community Services

Imagine going to bed each night, longing to wake up in a stable home with a family you can call your own. This is the broken reality for more than 14,000 foster children in Arizona.

Catholic Charities Community Services provides placement and adoption for foster children as well as education and certification for foster families throughout central and northern Arizona. They also serve at-risk youth, veterans, the homeless, domestic violence victims, and more than 20,000 vulnerable individuals each year. But they can’t do it without your help. You can make a difference in the life of a child. Your generosity can provide an education and the preparation to give one of these special children their very own family filled with love and compassion.

Simply redirect your state tax liability to Catholic Charities — up to $500 for single filers and $1,000 for joint filers. You’ll receive a dollar-for-dollar credit when you file your taxes. Visit Catholic Charities at www.catholiccharitiesaz.org, or call 1-855-316-2229 to learn the impact your gift makes.

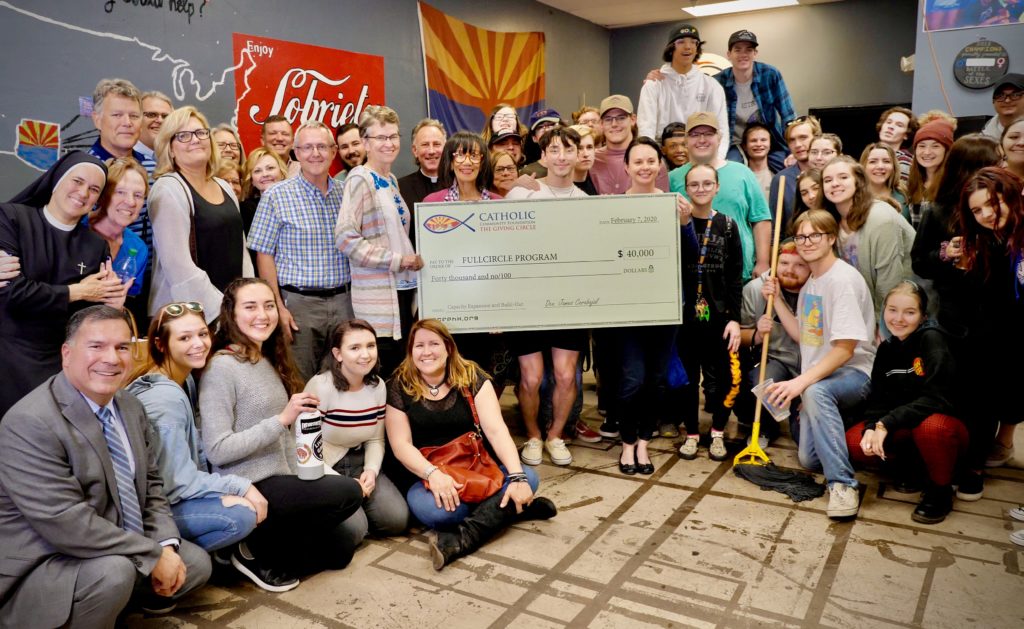

Catholic Community Foundation

Catholic Community Foundation (CCF) is a private 501(c)(3) philanthropic institution whose mission is to build the future of faith by providing sustainable support for those who serve the community.

Established in 1983, they are the “servant of servants,” called to assist local parishes, schools and nonprofits in building a secure and predictable future through endowments. CCF is paving the way for donors and recipient organizations to succeed together. They empower donors to grow their charitable gifts so that excess profits can be devoted to strengthening a faithful community for future generations. Since 1995, CCF has granted more than $27 million back into the community through:

- Donor-advised funds

- Charitable gift annuities

- Giving Circle grants

- Scholarships

- Savings and growth funds

- And many other ways

Catholic Community Foundation is a trusted philanthropic foundation for a faithful, sustainable future. You can learn more by visiting ccfphx.org or calling 480-651-8800.

Catholic Education Arizona

Catholic Education Arizona has been creating future leaders for 23 years. In fact, Catholic schools have a 99.4% graduation rate, with 97% enrolling in higher education or military service. Catholic Education Arizona has raised $268 million and awarded 138,000 scholarships to change lives, strengthen families and transform culture.

Thanks to Arizona legislation passed in 1997, individual taxpayers can direct a portion of their state tax liability in the form of tuition scholarships for underserved youth. Arizona private education tax credits are dollar-for-dollar credits against the state liability owed and can be taken by April 15 for the previous tax year. The 2020 tax credit maximums are $1,183 for single filers or $2,365 for joint filers.

Eligible corporations and insurance companies can also participate in the low-income and disabled/displaced corporate tax credits that assist students living within the federal poverty guidelines, children in the Arizona foster care system, those whose parents are stationed in Arizona, and exceptional learners.

With more than $9 million remaining to claim, interested corporations are encouraged to contact our office for more information. You can learn more by visiting catholiceducationarizona.org or by calling 602-218-6542.

The Society of St. Vincent de Paul

The staff and volunteers at The Society of St. Vincent de Paul never thought that, overnight, they would have to reinvent the entire food operations from dining room service to drive-through and to-go meals. However, that’s precisely what happened in March 2020, when the COVID-19 pandemic hit the Phoenix community.

Today, more than 4,000 meals continue to be packaged for individuals and families to pick up on a daily basis. Thanks to the staff and volunteers’ ingenuity and hard work, not a single meal was missed throughout the pandemic. They even converted the Dream Center children’s programs to take-home packets and activity kits.

St. Vincent de Paul’s family dining room, food boxes, medical and dental care, shelter and other services are nearly 100% funded by private donations. This is where you come in. Donors can claim up to $800 in Arizona charitable tax credits. Learn more at svdptaxcredit.info or call 602-226-4483.

Committed and heartfelt giving is the power that can help transform a life. Turn your Arizona tax liability into change for good or create an endowment by supporting the work of the Diocese of Phoenix non-profits and ministries that are proving love through action.